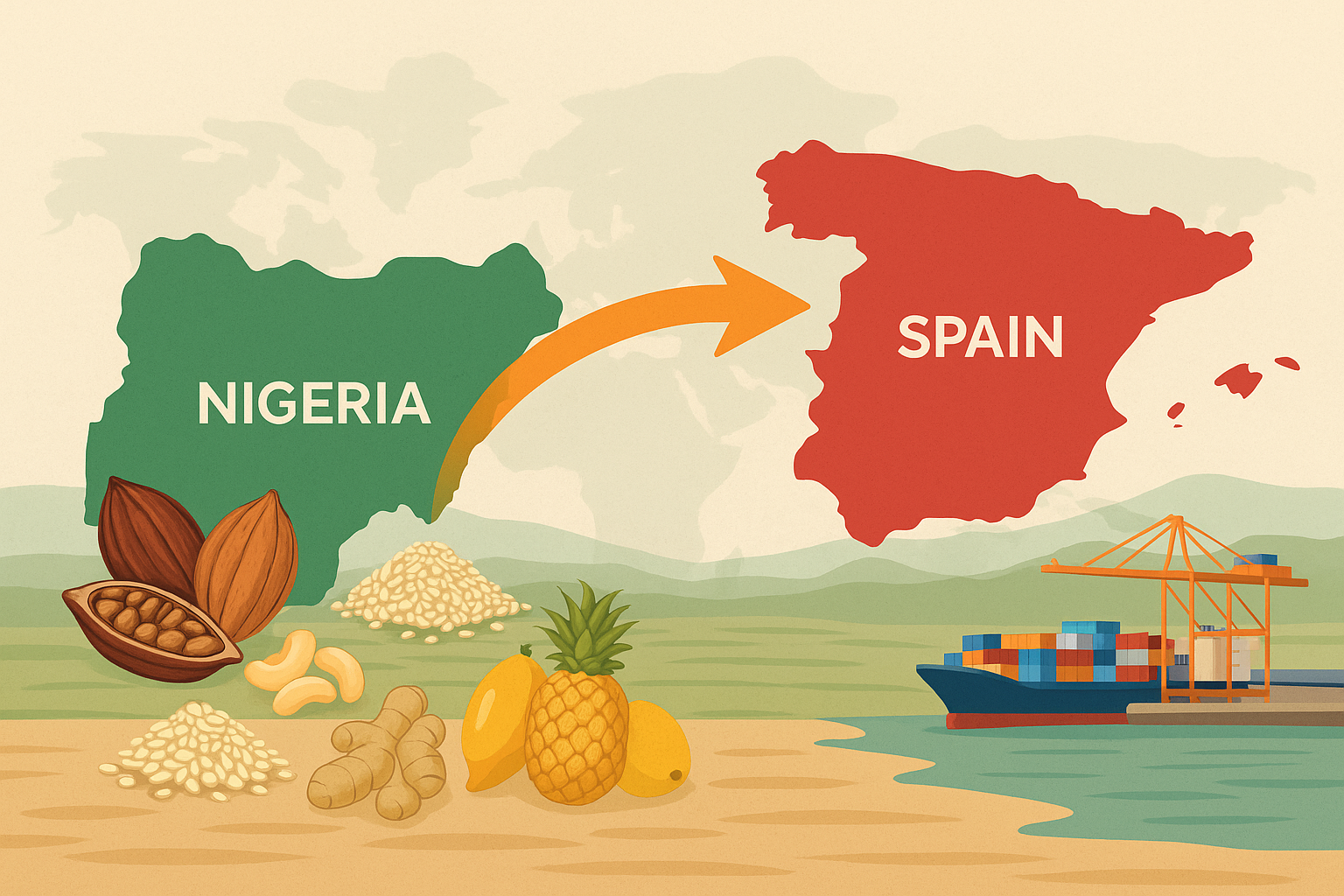

Spain is Europe’s 4th-largest economy (GDP ~$1.4 trillion) with 48 million people and a booming tourism industry (85 million visitors in 2023). It is also the leading EU producer of fruits and vegetables, yet it relies increasingly on imports to meet year-round demand. In 2023 Spanish ports handled nearly 12 million tonnes of fruit and vegetables (over half re-exported to other EU markets). This growing trade role makes Spain an attractive gateway: Nigerian exporters who can meet EU quality standards may find a receptive market, especially as Spain seeks exotic and out-of-season produce.

Spain’s retail consumers and food industry buy a wide range of imported agri-products. Tropical fruits and spices are in demand: recent analyses highlight major growth opportunities for avocados, berries, mangoes, pineapples, oranges, and grapes. Spanish supermarkets and wholesalers also import nuts, oils, and spice crops in modest volumes. For example, in 2023 Spain imported about 10,000 tonnes of fresh ginger (mostly from Peru, China and Brazil), signaling a rising market for spices and “superfoods.” Meanwhile, $430 million of fresh avocados and $300 million of berries were imported in 2023, reflecting strong consumer demand.

Historically, Nigeria’s exports to Spain have been dominated by petroleum products; in 2023 Spain bought ~$6.1 billion of Nigerian mineral fuels. In comparison, agri-commodities are still a small share. Official data shows Spain imported only ~$13.3 million of cocoa beans from Nigeria in 2023 (out of a global total of $273 million). Rubber and leather exports to Spain are also under $30 million. However, Nigerian producers are expanding non-oil exports, and Spain’s import trends suggest several high-potential crops for Nigerian exporters:

- Cocoa beans and products: Spain’s chocolate and confectionery industry is large, but it relies mostly on Côte d’Ivoire ($134M) and Ghana ($37M) for cocoa. Nigeria currently supplies only about $15 million of Spain’s cocoa bean imports (around 6% of the total). Nigerian cocoa has recognized quality, so there is room to grow market share. Processors in Spain (and throughout Europe) also demand cocoa butter and paste. In fact, Nigeria exported about $0.63 million of cocoa butter to Spain in 2024, showing an existing trade flow. Nigerian agribusinesses can target Spanish and EU chocolate makers by highlighting fermented and organic cocoa, and even consider investing in local processing (butter, powder) to add value.

- Cashew nuts: Nigeria is one of the world’s largest producers of raw cashews, but most of its exports go to Asia for processing. Spain, however, imports significant quantities of cashew kernels (over $100 million in 2023 according to industry data). Currently Nigeria’s direct export of raw cashews to Spain is very low (only about $235,000 in 2023). This gap indicates an opportunity: by working with Spanish nut processors or specialty importers, Nigerian suppliers could increase shipments of raw or minimally-processed cashews. Emphasizing sustainable sourcing and quality grading can help, since Spanish buyers value consistency.

- Sesame seeds: Global demand for sesame (used in cooking oils, bakery products and tahini) is strong. Nigeria is the world’s top exporter of sesame seeds (exceeding $450 million in exports). In 2023 Nigeria shipped about $0.96 million of sesame seeds to Spain (378 tonnes). While this is small compared to top suppliers, it shows entry. Nigerian exporters can target Spain’s seed oil and health food markets by offering high-purity, raw sesame. Certifications (organic, non-GMO) could add appeal. European buyers also use hulled sesame, so developing an export channel for both whole and hulled seeds can be beneficial.

- Ginger and spices: Spain’s ginger imports have been growing steadily, and demand for spices (pepper, turmeric, ginger) is also rising with interest in ethnic cuisines and health foods. Nigeria has suitable agro-climatic zones for ginger and other spices. Although Nigeria currently exports little fresh ginger to Europe, producers could fill niche demand by ensuring European phytosanitary standards. For example, Spanish supermarkets often sell organic ginger from Peru or China; Nigerian exporters entering this space would need to adopt similar quality controls and perhaps organic certifications. Other spices like chili peppers and turmeric may also find buyers in Spanish food processors and restaurants.

- Tropical fruits: Spanish consumers buy tropical fruits year-round, and large importers source them via Spain’s ports. Nigeria is a major producer of mangoes, pineapples and papayas. For instance, Nigeria is among the top global producers of mango and pineapple. If Nigerian exporters can handle post-harvest handling to EU quality (e.g. HACCP, GlobalGAP), there is potential to supply Spanish importers in the off-season. Fresh avocados are in particularly high demand in Spain. While most Spanish avocados now come from Latin America or the Canary Islands, Nigeria’s growing avocado industry (producing varieties like Hass) could explore niche supply, possibly targeting ethnic markets or organic retailers in Spain. Processed fruit (such as frozen mango cubes or dried fruit) is another angle – Spanish companies and food manufacturers import such ingredients from tropical origins.

Beyond these crops, there are smaller opportunities in soya cake and animal fodder (Spain imported ~$1.7M of oilseed residues from Nigeria in 2023), and natural rubber (Spain bought ~$27M from Nigeria) for its manufacturing sector. However, focus on food and edible goods makes more sense for many agribusiness SMEs.

Meeting Spain’s market requirements: Entering the Spanish market requires compliance with EU import regulations. Exporters should ensure products meet EU food safety, pesticide residue and plant-health (phytosanitary) standards. Certifications like GlobalGAP (for fresh produce) or organic labels can give Nigerian suppliers a competitive edge. Spanish buyers value consistent quality and year-round supply, so investing in cold storage, proper packaging, and reliable logistics (sea freight from Lagos to Algeciras/Valencia, for example) is crucial. Networking via trade fairs (e.g. Fruit Attraction in Madrid) and connecting with Spanish importers or re-exporters can open doors. The fact that Spain is a “re-export hub” means Nigerian goods can also reach other EU markets through Spain.

In summary, while Nigeria’s trade with Spain is still oil-dominated, the country’s farmers and SMEs have growing opportunities in Spain’s expanding food market. By targeting high-demand crops like cocoa, cashews, sesame, ginger and tropical fruits, and by aligning with Spanish quality expectations, Nigerian agribusinesses can diversify exports. The strong growth in Spain’s imports from developing countries suggests that with proper investment and trade support, Nigeria can capture a larger share of this market.