Trade Relations and Market Overview

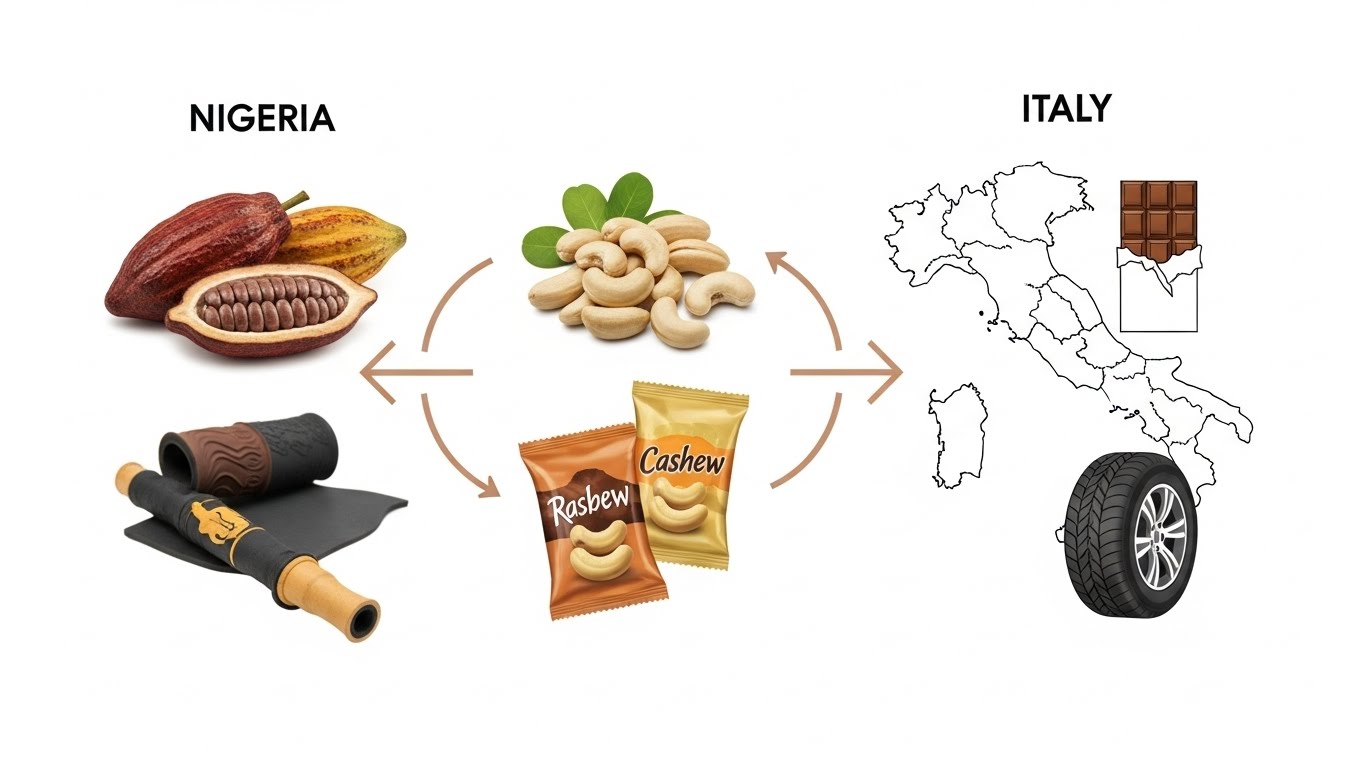

Italy is one of Nigeria’s long-standing trade partners, but most Nigeria’s exports to Italy remain dominated by oil and raw materials. Bilateral trade recently stood around ₦4.93 trillion (about $11 billion), with Nigeria running a large surplus thanks to fuel exports. Italian officials note that agriculture is a promising sector for closer cooperation. In practice, Italy imports relatively small quantities of Nigerian agricultural goods today. This gap suggests significant untapped potential: Italy’s industrial and food sectors (especially chocolate, confectionery and manufacturing) have high demand for raw materials that Nigeria produces. Nigerian agribusinesses and SMEs can therefore target Italian buyers by promoting cocoa, cashews, natural rubber and similar commodities that align with Italy’s import needs.

Key Agricultural Commodities

- Cocoa beans: Italy is a major chocolate producer (Europe’s 2nd largest) and a top 10 importer of cocoa beans. In 2023 Italy imported about $320 million worth of raw cocoa beans. Nigeria currently supplies roughly $23 million (≈7.4% share) of Italy’s cocoa imports, behind leading origins like Côte d’Ivoire and Ghana. As a top-4 global cocoa producer (behind Ivory Coast, Ghana, and Indonesia), Nigeria can expand exports to Italy by emphasizing quality. Italian buyers increasingly seek high-quality, often organic or Fair-Trade cocoa for their dark chocolate products. Nigerian exporters with certified, traceable cocoa can leverage this trend to gain market share.

- Cashew nuts: Italy’s imports of raw cashews are significant. In 2023 Italy imported about $78.9 million of cashew nuts. Major suppliers include Vietnam, Côte d’Ivoire and the Netherlands, while Nigeria’s share is relatively small – only about $1.26 million (≈1.6%). Given Nigeria’s abundant cashew harvests (Nigeria is among the world’s top producers), there is strong opportunity to increase exports to Italy. Nigeria could target niche segments (e.g. organic or specialty nuts) or supply raw cashews for Italy’s food processors. Building relationships with Italian importers and showcasing Nigeria’s cashew quality (e.g. size, taste) would help penetrate this market.

- Natural rubber: Italy imports large volumes of natural rubber for its automotive and manufacturing industries. In 2023, Italy imported $137.0 million of “technically specified natural rubber” (HS 400122). Top suppliers were Côte d’Ivoire, Thailand and Indonesia, but Nigeria already ranks as a notable source: Nigeria supplied about $12.3 million of that rubber (≈9% of Italy’s imports). This makes Nigeria the fourth-largest supplier of primary natural rubber to Italy, behind Cote d’Ivoire, Thailand, and Indonesia. Nigeria’s rubber industry can aim to grow this share by ensuring consistent supply and meeting European quality standards. Many Italian firms use rubber in tires and machinery, so highlighting Nigeria’s sustainable production (e.g. environment-friendly tapping, certifications) could open new deals.

- Other crops: While our focus is on cocoa, cashew and rubber, Nigerian SMEs should also monitor related products in Italy’s import mix. For example, Italy imports tropical oils and nuts; although current palm oil imports from Nigeria are tiny (negligible), there could be niche demand for Nigerian shea butter or gourmet oils. Additionally, spices or fruit (e.g. ginger, chili) may be longer-term prospects if quality and supply chains improve. The key is to match any additional crop to Italy’s existing import needs (e.g., specialty ingredients for confectionery or health foods).

Matching Italian Demand

Italy’s consumption patterns offer clues for exporters. Italians eat about 4 kg of chocolate per person annually, with a growing appetite for dark and premium chocolate. This strong chocolate industry (with companies like Ferrero, Perugina and others) means stable demand for cocoa beans. Nigerian producers should highlight bean quality (flavor, low bitterness) and certifications to meet Italy’s high standards. For cashews, while Italy’s domestic consumption is moderate, the processing and snack industries rely on imported nuts, often preferring origins like Vietnam. Nigeria can position its cashews as a specialty or value-add ingredient (e.g. lightly smoked or sun-dried) to differentiate from competitors. For rubber, Italy’s auto and machinery sectors demand consistent quality grades; exporters should ensure compliance with EU safety and technical standards (e.g. REACH regulations if any rubber chemicals involved).

Italian buyers also value quality and packaging. The Italian market trend is towards high-quality, certified, often organic products. Nigerian exporters should therefore adopt global certifications (Fair Trade, Rainforest Alliance, ISO standards) and invest in professional packaging. Attractive, informative packaging (in Italian or English) that emphasizes product origin and sustainability can improve marketability. For instance, cashew nuts or cocoa packaged in moisture-proof, resealable bags with clear labeling (nutrient info, origin) will appeal to Italian importers and retailers. Participating in trade fairs in Italy or using Italy’s trade agencies (like the ICE office in Lagos) can also help forge contacts and understand Italian buyer expectations.

Strategic Steps for Nigerian Exporters

- Leverage Trade Data: Utilize resources like the EU Trade Helpdesk to identify Italy’s top imports in cocoa, nuts, and rubber, and see where Nigeria ranks. For example, current data shows Nigeria already has entry-points (7.4% of Italy’s cocoa imports, 1.6% of cashew imports). Exporters can target gaps by pitching increased volumes to Italian importers.

- Meet Standards: Ensure all exports meet EU phytosanitary and quality standards. This includes proper fumigation, pesticide limits, and no-aflatoxin certification for nuts and cocoa. Ghana and Côte d’Ivoire’s experience exporting cocoa to Europe offers a model – Nigerian exporters should adopt similar quality control.

- Highlight Value-add: Where possible, offer semi-processed goods. For example, shipping shelled or roasted cashews rather than raw kernels could fetch higher prices if competitive. In cocoa, consider exporting not just beans but also cocoa liquor or butter, if facilities allow, as Italy has cacao processing capacity. However, even raw commodities must be top-grade.

- Build Partnerships: Engage with Italian trade bodies and trade fairs (e.g. Cibus in Parma for food, Progetto V in Milan for tropical products) to pitch Nigerian products. The Italian government’s Mattei Plan aims to boost Africa-Europe trade, and the Lagos ICE trade office is a resource for Nigerian exporters. Use these channels to learn Italy’s evolving needs.

Conclusion

Italy’s agricultural import market is substantial and open to diversification. By focusing on cocoa, cashew, and rubber, Nigerian agribusinesses can align with Italy’s demand for these commodities. Current trade data shows Nigeria already participates (though modestly) in these markets, indicating a foundation to build on. Nigerian SMEs should capitalize on Nigeria’s production strengths—leveraging quality, certification, and effective marketing—to expand exports to Italy. With the right strategies and partnerships, these sectors offer promising avenues for growing Nigeria’s exports and integrating Nigerian agriproducts into Italy’s food and industrial supply chains.