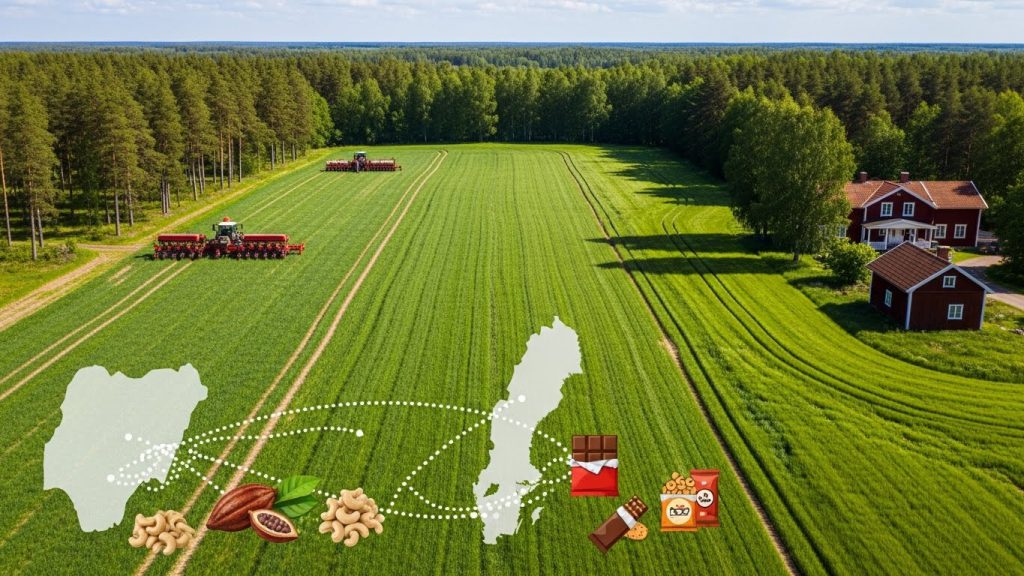

Nigeria–Sweden Agro Export Opportunities

Nigeria is Africa’s largest economy and a major producer of agricultural commodities. While its economy still depends heavily on oil, Nigerian policymakers are pushing to diversify exports toward non-oil goods like cocoa, cashew and rubber. Sweden, with its strong consumer demand for high-quality, sustainable foods, represents an underexploited market for Nigerian agriproducts. Sweden imported SEK 225.3 billion in food and agricultural products in 2024 (roughly constant with 2023). Notably, Swedish imports of coffee, tea and cocoa jumped +16% in 2024 – reflecting growing interest in premium and specialty cocoa. At the same time, Sweden’s market for nuts and healthy snacks is robust: in 2020 Swedes consumed about 17,630 tonnes of nuts (€109 million), with cashews alone accounting for 3,028 tonnes (€19.1 million). These trends suggest real opportunities for Nigerian exporters to enter Sweden’s market with competitive offerings in cocoa and cashew. (Sweden’s import of natural rubber is modest, but its industries rely on rubber inputs; Nigeria is a leading African rubber producer and could tap sustainability-minded European supply chains.) Throughout, Swedish buyers emphasize organic, fair-trade, and “LOHAS” (Lifestyles of Health and Sustainability) values – over 30% of Swedes identify with health/environmentally conscious lifestyles – so Nigerian exports must meet high quality, certification and ethical standards.

Nigeria’s Current Exports to Sweden

As of 2023–24, Nigeria’s exports to Sweden have been small compared to major partners like the Netherlands or India. The bulk of Nigerian shipments to Sweden remain in petroleum products and raw materials. Exports of cocoa, cashew, rubber (and other agro-crops) to Sweden are currently minimal, meaning Nigeria’s potential is largely untapped. For example, Sweden’s cashew imports come almost entirely from Vietnam, India and other suppliers, with little direct trade from Nigeria. Similarly, Scandinavian countries import only a few tens of tonnes of raw cocoa beans each year, mostly re-exported via Denmark. In short, direct Nigeria→Sweden trade in these commodities is nascent, suggesting space for growth. Meanwhile, Nigeria’s export profile is rich in these items: Cocoa, cashew nuts and rubber are already among Nigeria’s top non-oil export commodities. The Nigerian Export Promotion Council and trade bodies have been encouraging producers to meet international standards so they can access new EU markets. In practice, Nigerian SMEs could start by targeting Swedish importers of bulk raw materials or processed ingredients (e.g. cocoa processors, nut wholesalers, rubber manufacturers) who source via EU brokers.

Sweden’s Agricultural Import Trends

Swedish food import trends point to clear areas of opportunity. According to a recent Swedish trade study, imports of coffee, tea and cocoa products grew sharply (+16%) in 2024. Fruit and vegetables, beverages and dairy also rose modestly, while oils and fats declined. The key imported categories are coffee & specialty beverages, fruit & vegetables, vegetarian foods and grains. Notably, Sweden has a highly concentrated retail sector (top 3 chains ~90% of market) and a sophisticated consumer base. Swedish consumers are very health- and environment-conscious: about 30% of Swedes identify with the “Lifestyles of Health and Sustainability (LOHAS)” segment, and organic sales account for roughly 9% of retail. This means that products labeled organic, fair-trade or climate-friendly tend to perform well. For example, Scandinavian chocolate buyers often require certified cocoa (e.g. UTZ/Rainforest Alliance) for private labels. In short, Swedish importers are looking for quality and traceability as much as price.

In the nuts and snacks category, Sweden’s market is robust and growing. In 2020 Swedes ate ~17,630 tonnes of nuts worth €109M (up €19.1M). (Almonds and walnuts lead at €39M and €21M respectively, but cashews are #3.) The nut & snack industry is benefiting from health-food trends – sales of nut-based snacks have outpaced the broader snack sector in recent years. This healthy-snacking trend will favor natural cashews and other tree nuts. For Nigerian SMEs, this means that high-quality cashews (especially if branded as nutritious or organic) could find a welcome audience.

Imports of natural rubber into Sweden are small; most rubber products come via EU manufacturing hubs. Still, Nigeria is a major rubber producer – the 3rd largest in Africa and 11th in the world – and global demand for sustainably-sourced natural rubber is rising (for tires, auto parts, industrial goods). EU regulations on deforestation and ethics mean Swedish buyers may look for traceable rubber suppliers. Although currently negligible, Nigerian natural rubber (properly certified) could serve Swedish industries such as automotive or medical supplies looking for new sources of raw rubber. There are precedents: Europe’s largest importer of Nigerian rubber has been Belgium, but with air-freight costs down and sustainability premiums up, Sweden could diversify its rubber imports.

Cocoa: Premium and Sustainable Sourcing

Cocoa is Nigeria’s single largest non-oil export, and Swedish demand for cocoa is on the rise. From 2021–2024, total EU imports of cocoa preparations grew (CBI data shows EU chocolate market expanding ~5% annually). Though Scandinavia is a very small cocoa importer (Sweden imported only ~43 tonnes in 2020), that volume has been growing by ~17% annually. Currently ~60% of Swedish cocoa beans come via Denmark. However, niche “bean-to-bar” chocolatiers and large brands alike are increasingly sourcing directly from origin to meet consumer demand for traceability. Swedish chocolate makers (e.g. Cloetta, Mondelez) have strong sustainability commitments and often require certified cocoa. Moreover, the LOHAS trend means Swedes favor dark chocolate, sugar-free and organic options.

Opportunities: Nigerian cocoa exporters can target Swedish buyers by emphasizing quality and sustainability. For example, a certified organic or Fairtrade cocoa program could differentiate Nigerian beans. Given rising demand, even a small annual supply (hundreds of tonnes) could attract niche importers who tell a story of African origin. Swedish buyers often attend European trade fairs and use platforms (like ITC Trade Map) to find sources. They also value consistent volumes: Nigeria’s ambitious cocoa expansion plans (aiming for 500,000+ tons by 2025) could eventually make it a reliable source. In the meantime, Nigerian exporters might first focus on semi-finished products (like cocoa nibs or paste) if logistic costs allow, since Sweden has chocolate factories (and increasingly demand for craft and high-end beans). Partnerships with Danish or Dutch traders could also be a stepping stone to reach Swedish markets.

Cashew: Growing Nut Market

Cashew nuts are another strategic crop for Nigeria (it’s Africa’s largest cashew producer). Yet most Nigerian cashews are exported to Asia for processing, limiting exports to Europe. Sweden, on the other hand, is importing increasing quantities of processed cashew products for its snack and food industries. As noted, Sweden bought over 3,000 tonnes of cashews in 2020. The Swedish nut trade is characterized by value-added: imported raw or roasted cashews are often salted/spiced or used in food processing, creating local jobs.

Opportunities: Nigerian exporters can pursue both raw and processed cashew markets. Raw cashew kernels (RCKs) from Nigeria could be sold to Swedish snack manufacturers or wholesalers who then roast and flavor them. However, given Sweden’s trend toward healthier eating, there is opportunity for minimally processed or organic cashews as premium snacks. The quotation from industry notes that “both raw, salted and spiced cashew nuts do competitively well” in Sweden. Thus, Nigerian SMEs might supply small volumes of high-quality RCKs (e.g. strictly dried, sorted) to test the market. Alternatively, cooperative ventures could be formed to ship processed cashew (if local processing capacity improves). Importantly, Nigerian exporters should highlight certifications (GlobalGAP, organic) and possibly participate in Nordic trade fairs (like the food section of FoodExpo Copenhagen or Scandinavian Organic Food events) to meet buyers. Even though Swedish buyers currently source mostly from Vietnam and India, Nigeria’s cashews have the advantage of supporting Africa’s economy and could tap into CSR-driven purchasing.

Rubber: Industrial Raw Material Potential

Nigeria also produces significant natural rubber, grown in southern states. Historically an important export, rubber declined after the 1980s but is now resurging. The EU (including Sweden) remains the world’s largest importer of natural rubber, mostly for tire and equipment manufacture. While Sweden does not import much raw rubber directly, its industries (e.g. automotive, machinery, medical devices) rely on rubber inputs. In fact, roughly 72% of Nigeria’s rubber exports go to the EU (mainly via Belgium). As Europe tightens sustainability standards, Swedish manufacturers may seek certified natural rubber (to comply with deforestation regulations and corporate policy).

Opportunities: Nigerian SMEs and cooperatives in rubber could explore niche supply agreements with European buyers. For example, a Swedish tire components maker might be interested in Ghanaian or Indonesian natural rubber – similarly, Nigeria’s rubber could be attractive if offered under an ethical, traceable scheme. Emphasizing that Nigeria is undertaking reforestation and responsible rubber practices could reassure EU partners. Even if volumes start small, forming joint ventures (processing raw rubber into technical sheets or treads in Nigeria) could be a long-term strategy. At minimum, Nigerian traders should highlight that Nigeria is one of Africa’s top rubber producers and seek to list products on EU trade databases so buyers can discover them.

Actionable Insights for Nigerian SMEs

To capitalize on these opportunities, Nigerian agribusinesses and SMEs should:

- Align with Swedish buyer criteria: Register with export promotion portals (e.g. Open Trade Gate Sweden, the National Board of Trade’s guidance for developing countries) to get market info. Invest in certifications (organic, Rainforest Alliance/UTZ, HACCP) since Swedish retailers often require them.

- Focus on quality and consistency: Sweden is a small market that values reliability. Begin with small shipments to build relationships. For example, selling a first batch of special-grade cocoa beans with full traceability can secure a stable buyer later.

- Leverage trade platforms: Use trade intelligence (like ITC’s Trade Map) and attend EU trade fairs (e.g. Anuga, Gulfood, Nordic Organic Food) where Swedish importers source products. Networking with the African diaspora in Sweden (who may help open doors to food importers) can also help.

- Highlight sustainability: Frame exports as part of eco-friendly development. Swedish consumers and regulators care about deforestation and carbon footprints. Marketing Nigerian cocoa or cashew as “forest-friendly” or as empowering smallholders resonates in Sweden.

In summary, Sweden’s strong economy and consumer preferences make it a promising market for Nigerian agricultural exports. Focusing on cocoa and cashew – where Sweden’s import demand is high and growing – is especially strategic. By improving product quality, obtaining certifications and targeting niche health-food and gourmet segments, Nigerian agribusinesses can expand into Sweden. Rubber and other crops (like sesame or ginger) may offer supplementary prospects, especially if tied to sustainability initiatives. With the EU market shift toward diversified, ethical sourcing, well-organized Nigerian SMEs have a clear path to increase exports to Sweden.